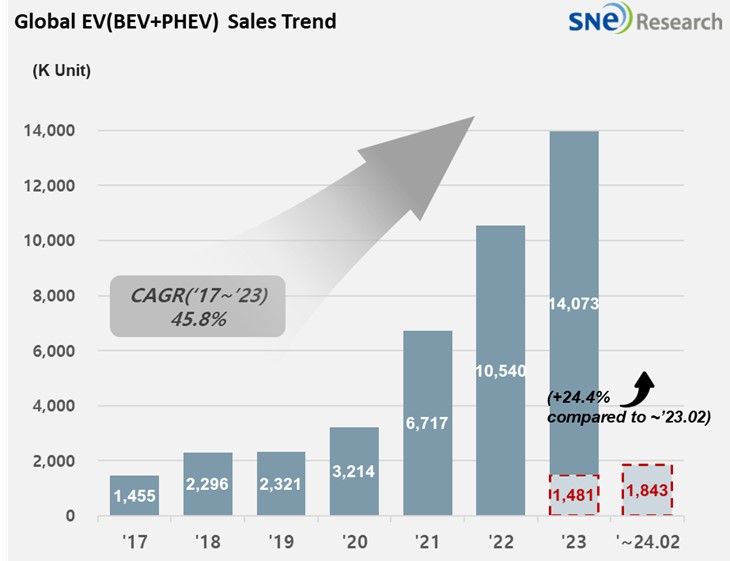

From Jan to Feb 2024, Global[1] Electric Vehicle Deliveries[2] Posted Approx. 1.843 Mil Units, a 24.4% YoY Growth

- BYD ranked top in global EV sales

From

January to February 2024, the number

of electric vehicles registered in countries around the world was approximately

1.843 million units, a 24.4% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Mar 2024, SNE Research)

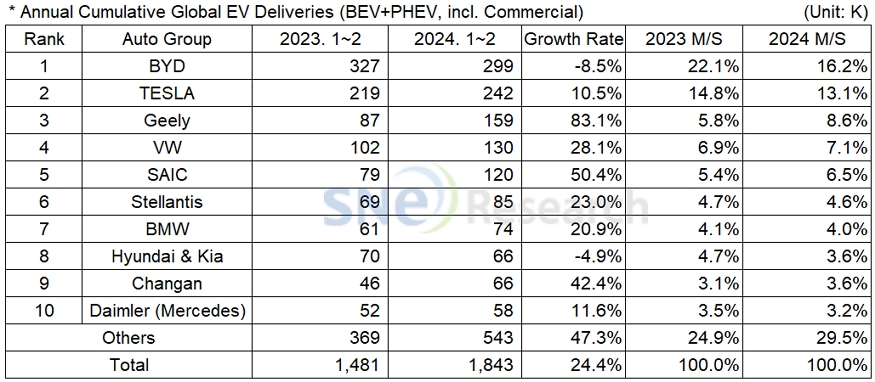

If we look at the global EV sales by major OEMs from Jan to Feb 2024, the leading EV maker in China, BYD posted a -8.5% YoY growth but still maintained its global No. 1 position. BYD remained on the top of the list thanks to favorable sales of light EVs such as Seagull (海鸥) and Dolphin (海豚). Not only with those light EV models, BYD gradually expanded its market share with a broad range of option to drivers by offering various segments such as Song and Yuan plus and establishing sub-brands like Denza(腾势) and Yangwang(仰望). Tesla posted a 10.5% YoY growth supported by the sales of Model Y and ranked 2nd on the list. If we compare the sales of BEV only, Tesla with 242k units obviously outperformed BYD with 156k units.

The 3rd place was taken by Geely Group. Similar to BYD, Geely’s light EV model, Panda (熊猫) MINI saw more than 16k units sold, looking quite favorable to Geely. The Group, a parent company of Volvo has launched sub-brands such as Galaxy (银河), ZEEKR (极氪), and LYNK & CO (领克) to target the mid/high-end vehicle market by adding more diversity to its portfolio.

(Source: Global EV and Battery Monthly Tracker – Mar 2024, SNE Research)

Hyundai-KIA Group posted a -4.9% YoY growth. Such degrowth was resulted by a slow sale of IONIQ 5/6 and EV6, but the global sales of new KONA Electric (SX2 EV) and EV9 has expanded and the overseas sales of Tucson PHEV saw an increase. Hyundai Motors unveiled ‘2024 Kona Electric,’ ‘IONIQ 6 Black Edition’ and ‘The New IONIQ 5’ of which overall commercial value was heightened with battery performance enhanced and user-friendly features added. In addition, it also announced its target of becoming the global top 3 by investing 24 trillion won in electric vehicles by 2030. Kia was reported that it would focus on reinforcing the leadership in the eco-friendly vehicle market by starting the overseas sales of EV9 and selling mid- and small-size EVs – from EV3 to EV5 with price competitiveness. It was known that KIA also wants to increase the profitability through the expansion of car sales.

(Source: Global EV and Battery Monthly Tracker – Mar 2024, SNE Research)

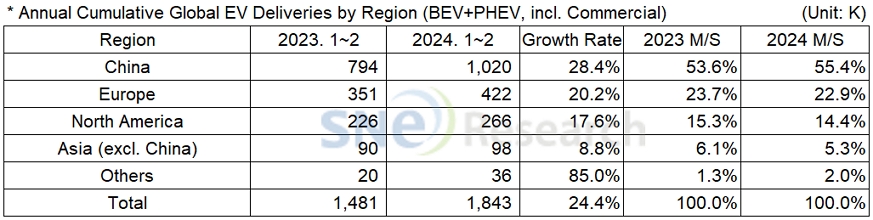

By region, China firmly kept its position as the world’s biggest EV market, taking up 55.4% of the entire market share. Due to the Chinese New Year holidays in February, the growth slowed down a bit. However, unlike the beginning of last year when the EV sales significantly dropped because of the termination of subsidy policy, it seems that electric vehicles in China have been popularized in full scale based on the increased production of light electric vehicles with price competitiveness, expansion of customer choices with the launch of sub-brands by major OEMs, and the China’s New Energy Vehicle mandate policy.

In Europe, EVs accounted for 20.2% of the market share, with BEV, PHEV, and HEV all showing a similar level of growth. The growth of BEV in Europe was found to be noticeably slowing down compared to the previous trend. The recent change can be attributed to some of the European countries, mainly led by Germany and Italia – two powerhouses in the global auto industry – which expressed their opposition to the 2035 ICE ban proposed by the EU. In addition, as it was agreed upon the introduction of Euro 7 of which emission standard takes the lowest limits seen in the previous Euro 6, it has become obvious that the growth of electric vehicle market in Europe has hit speed bumps.

In North America, the EV market showed a growth supported by sales of Tesla and JEEP’s PHEV line-up. While the North American EV market had stayed in an upward trend thanks to tax credits provided by the IRA, it gradually turned into a slowdown from the latter half of 2023. In addition, with the next presidential election scheduled at the end of this year, the Biden administration has been revising and reviewing its plan to strengthen the emission regulations as part of slowing down the transition to electric vehicles. Former US president, Donald Trump, rebuked the green policy by the incumbent government and expressed his opinion that the US should focus more on vehicles with internal combustion engine.

With the trend of high interest rates continued across the world, as major countries such as the US and Europe have been witnessing a sudden emergence of speed bumps in transition to electric vehicles, major OEMs decided to postpone their electric vehicle investment plans and electrification strategies or reduce the scale of those plans accordingly. Currently, transition to electric vehicles is not the matter of choice anymore, but it is rather the matter of transition pace. Given the current circumstances, it is forecasted that demand for hybrid vehicles, which can play a role as steppingstones during the transitional period and help electric vehicles disseminate from early adapters to the public, would enjoy a gentle increase in the coming years.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period